Understanding Currency Conversion: Converting 1 Billion Won to USD

Currency conversion plays a significant role in today’s interconnected global economy. Whether for business purposes, travel, or investments, understanding exchange rates can help individuals and corporations make informed financial decisions. One frequently discussed conversion is between South Korea’s currency, the Korean Won (KRW), and the United States Dollar (USD). If you’ve ever wondered what 1 billion won equates to in USD, this article will provide an in-depth exploration of that conversion, alongside factors influencing exchange rates, historical trends, and practical applications.

Current Conversion Rates

To accurately convert 1 billion won to USD, the current exchange rate is crucial. Exchange rates fluctuate constantly due to factors like economic policies, international trade dynamics, and geopolitical events. As of now (date-specific data varies), 1 KRW equals approximately $0.00075 USD.

Using this rate, the calculation is:

Thus, 1 billion won is approximately 750,000 USD. This approximation may vary slightly depending on real-time updates from currency conversion platforms.

Breakdown of the Korean Won and US Dollar

Korean Won (KRW):

The won (₩) is the official currency of South Korea, managed by the Bank of Korea.

Denominations include coins (10, 50, 100, 500 won) and banknotes (1,000, 5,000, 10,000, 50,000 won).

South Korea’s economy ranks as one of the world’s largest, and the won’s value is a key indicator of its financial health.

US Dollar (USD):

As the global reserve currency, the US dollar ($) plays a central role in international finance.

It’s issued by the US Federal Reserve and holds a reputation for stability, influencing the value of other currencies like the won.

Factors Influencing Exchange Rates

Exchange rates between KRW and USD are affected by various global and domestic factors:

Economic Indicators:

GDP Growth: Stronger growth in South Korea can lead to a higher demand for won, potentially strengthening its value relative to the USD.

Inflation Rates: Lower inflation rates often correlate with stronger currencies.

Central Bank Policies:

The Bank of Korea’s interest rate decisions affect how attractive the won is compared to the dollar

Similarly, the US Federal Reserve’s policies play a pivotal role in global financialmarkets.

Trade Balance:

South Korea’s significant export-driven economy relies on industries like electronics, automotive, and shipbuilding. A trade surplus typically boosts the won.

Conversely, higher US imports of Korean goods can lead to an increased demand for won.

Geopolitical Stability:

South Korea’s geographic proximity to North Korea means political tensions can cause exchange rate fluctuations.

US global policies, economic sanctions, or trade disputes also influence currency markets.

Market Speculation:

Investors trading KRW and USD in forex markets create volatility. Speculative buying or selling impacts short-term rates.

Historical Exchange Rate Trends

Historical data showcases the dynamic nature of KRW-USD exchange rates. Here’s an overview of key periods:

1980s: The Korean won was pegged to the US dollar, leading to relatively stable rates.

1997-1998 Asian Financial Crisis: South Korea devalued the won due to economic instability, with 1 USD exceeding 1,800 KRW at one point.

2008 Global Financial Crisis: The won again experienced significant depreciation, briefly trading at over 1,500 KRW per USD.

2010s and Beyond: Steady recovery in the Korean economy saw the won fluctuate between 1,100-1,300 KRW/USD, influenced by trade and global events.

Currently, rates hover around the 1,300 KRW/USD mark as global economic uncertainties persist.

Applications: How Does the Conversion of 1 Billion Won to USD Affect You?

1 billion won may sound abstract, but in USD terms (approximately $750,000), it has real-world applications:

Business Transactions:

South Korean Enterprises: Exporters benefit from favorable exchange rates when selling products priced in USD.

US Companies: Importing goods from South Korea becomes more affordable when the USD strengthens against the KRW.

Real Estate Investment:

For international buyers, South Korea’s real estate offers lucrative opportunities. A 1 billion won property equates to $750,000, making it attractive for foreigners seeking luxury apartments or commercial spaces in Seoul.

Education and Living Expenses:

South Korea attracts many international students. Knowing the USD equivalent of won-based tuition helps plan finances.

Tourism:

Travelers from the US can stretch their budgets when the won depreciates, experiencing a cost-effective trip to destinations like Jeju Island or Seoul.

Real-World Examples of 1 Billion Won in USD

1 billion won can represent various real-world values:

Technology: Approximately the cost of a high-end electric vehicle model from Hyundai’s luxury Genesis brand.

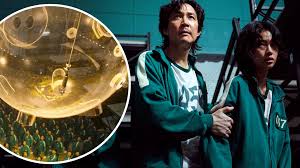

Entertainment: Equivalent to the budget for producing certain South Korean films or drama series.

Startups: Seed funding for a South Korean startup.

Tools for Accurate Currency Conversion

To stay updated on the KRW-USD exchange rate, the following tools are helpful:

Online Converters: Platforms like XE, OANDA, and Google provide real-time conversion rates.

Mobile Apps: Apps from forex platforms ensure access on the go.

Banks: Major banks like KB Kookmin or Citibank often feature currency calculators.

Forex Platforms: Ideal for investors and businesses requiring detailed analysis and hedging options.

Challenges and Risks in Currency Conversion

Exchange Rate Volatility: Sudden geopolitical or economic changes can alter rates drastically.

Fees: Banks and currency exchangers may include service charges or less favorable rates.

Market Timeliness: Timing plays a critical role; choosing the right time to convert can yield better value.

Optimizing Currency Conversion

For businesses or individuals dealing with substantial sums like 1 billion won, the following strategies can optimize value:

Hedging Strategies: Use financial instruments to lock in favorable rates.

Monitor Trends: Keep an eye on economic indicators in both countries.

Diversify Transactions: Spread conversions across multiple transactions to avoid volatility risks.

Conclusion

Converting 1 billion won to USD is more than a simple arithmetic calculation. Understanding the process requires knowledge of current exchange rates, the factors influencing these rates, and their applications. Whether you’re a traveler, business owner, investor, or simply curious about global markets, staying informed can lead to better financial decisions.

The conversion of 1 billion won to approximately $750,000 USD serves as a prime example of how global currencies intertwine in our everyday lives. By leveraging tools, tracking trends, and planning strategically, one can navigate the complexities of currency exchange effectively.